Share

The Other Hand

It keeps raining cash on the Finance Minister. A big budget is coming.

Still drowning in cash, the new Finance Minister is warned by IFAC, yet again, not to spend it.

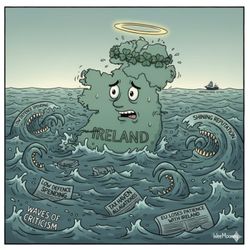

Are the fiscal giveaways of past budgets really costing each household €1000 a year?

Amidst all the cries of 'they are windfall taxes' it's forgotten that capital investment is - or should be - very different to current spending. We used to argue about borrowing for investment purposes - economists have always pointed that that borrowing for investment is perfectly ok, provided the return on that investment is higher than the cost.

Now, some seem to be arguing that spending money that we already have, windfall or otherwise, still shouldn't be spent, even on high return projects. There's crying wolf and then just being daft.

GDP data is all over the place and has defeated us. Exchequer returns and other data point to an economy still growing although not one that is overheating. Tax revenues are booming and unemployment is down again.