Share

The Other Hand

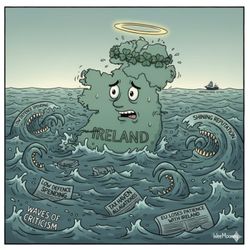

Needed: a resilient domestic economy. Shocks are certain. Only question is when

•

The arguments over the help needed for the domestic economy run and run

Is Sinn Fein just a reunification party with a few half-hearted populist policies thrown in to get elected?

Neither Chris nor Jim won the economics Nobel Prize.

And much more!