Share

The Other Hand

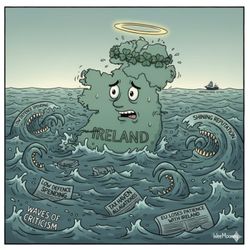

The post-budget state of Irish politics: in conversation with leading Irish journalist Sarah Carey

•

Has the coalition blown it? Or does the outpouring of budget criticism from official Ireland miss the point: it's what the people wanted?