Share

Money Talks from The Economist

Triple threat: the European economy has a Trump problem

Europe’s economy is in trouble. Growth has been moribund for a decade and a half. Worries about the continent's shaky fiscal foundations and its heavy regulatory burden are only growing. Now, governments across the continent have a third economic threat to worry about: Donald Trump. The US president has threatened tariffs on European exports and told Nato allies they should spend 5% of GDP on defence—an unaffordable expense for most of the region. So how much trouble is Europe in?

Hosts: Mike Bird and Ethan Wu. Guests: The Economist’s Christian Odendahl and Stanley Pignal; and Luis Garicano, an economist and former member of the European Parliament.

Transcripts of our podcasts are available via economist.com/podcasts.

Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.

For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

More episodes

View all episodes

Giving credit: the rise of buy now, pay later

43:14|It started over a century ago with instalment loans for big ticket items. But today, buy now, pay later can be used for almost anything, from Coachella tickets to your lunchtime burrito. This new form of consumer finance has attracted criticism for enticing younger borrowers with limited credit histories into debt. But despite critics' reservations, the market is booming. BNPL accounted for $342bn in spending around the world last year, up from $2bn a decade earlier—and major investment funds are getting in on the action. Is BNPL the future of consumer finance?Hosts: Mike Bird, Alice Fulwood and Ethan Wu. Guests: Max Levchin, co-founder and CEO of Affirm, and Vaibhav Piplapure, managing director at KKR’s asset-based finance team.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Gone fishing: our economics editor’s Jackson Hole diary

39:19|The annual gathering of central bankers in Jackson Hole is usually spent poring over speeches for clues on interest rates, and in high-minded scholarly discussion. But this year there was a twist. On the eve of the conference, President Trump threatened to sack one of the Fed’s governors. Fortunately, our economics editor Henry Curr was there with a microphone to capture the action as it unfolded. Hosts: Alice Fulwood, Ethan Wu and Mike Bird. Guests: The Economist’s Henry Curr.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

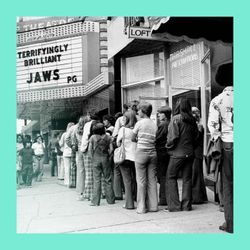

Money Talkies: economics lessons from the movies

38:06|Lights, camera, economics! This week, we bring you something different: the premier of the Money Talks film club. So get yourself a large soda (no ice), some popcorn and find out what economic lessons Alice, Mike and Ethan have learnt from their favourite films.Hosts: Alice Fulwood, Mike Bird and Ethan Wu.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Fee-asco: why Trump’s tariffs have hit South-East Asia so hard

47:33|President Trump's sweeping tariffs took effect last week, imposing seemingly arbitrary levies on goods arriving to America from much of the world. They range from 10% on UK-made products to 50% on shipments from Brazil. But one region has been hit particularly hard: South-East Asia. A growing share of US imports are made in the region, which has benefitted from a push by manufacturers to diversify their supply chains away from China. But do Trump’s tariffs, and his ill-defined crackdown on “transshipment”, threaten the factory model that has propelled the region’s growth?Hosts: Ethan Wu, Alice Fulwood and Mike Bird. Guests: Louise Loo of Oxford Economics; former White House supply-chain expert Peter Harrell; and Malaysia’s deputy trade minister Liew Chin Tong.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Stablecoins: is this crypto’s big bang moment?

46:55|For years, Wall Street has been stuffed with crypto sceptics, who couldn't see the point in digital assets. But now, even the most straight-laced parts of traditional finance are starting to see new use cases. Last month, President Trump signed into law the GENIUS Act, which signals a new era for one type of cryptocurrency in particular: stablecoins. It’s easy to see how these tokens backed by other assets, usually the dollar, could make transactions simpler. But it’s also easy to see how they could pose a threat to the stability of the financial system as we know it.Hosts: Mike Bird, Ethan Wu and Alice Fulwood. Guests: Sandy Kaul, head of innovation at Franklin Templeton; and Johann Kerbrat of Robinhood.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Artificial intelligentsia: an interview with the boss of Anthropic

48:09|Dario Amodei is an unusual figure to lead one of the world’s most valuable AI firms. Unlike most CEOs, he spends more time talking about geopolitical tensions or the huge job losses his industry is likely to be responsible for than Anthropic's commercial strategy. Safety is central to the company’s mission—and it sells. Revenues appear to be on track to near $10bn this year. That’s ten times more than last year. So how should we think about the seemingly unstoppable rise of Anthropic?Hosts: Alice Fulwood, Mike Bird and Ethan Wu. Guests: The Economist’s Henry Tricks; Dario Amodei and Anthropic’s in-house philosopher Amanda Askell.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Chip lords: the world's most important company

43:58|Around 90% of the world’s leading chips are made by TSMC, and most of them in Taiwan. Without those chips, the most critical advancements in AI—or even in the latest iPhone—would not have been possible. So how did one company become so dominant? And should the world be so dependent on chips made in a country on a geopolitical faultline between China and America?Hosts: Ethan Wu and Mike Bird. Guests: The Economist’s Shailesh Chitnis; Chris Miller, author of “Chip War”; Asianometry founder Jon Yu; and Wendell Huang, CFO of TSMC.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

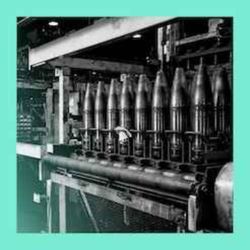

Combat capitalism: how Ukraine built a war economy

35:47|When Russia invaded its neighbour in 2022, Ukraine’s lack of industrial capacity put it at a distinct disadvantage. Typically, the country with the most factories was expected to win the war—and Russia had a lot of factories. But, as manufacturing has become more specialised and the tools of war have become more complex, the relationship between peacetime industrial capacity and battlefield success could be breaking down. This has huge implications for future wars.Hosts: Ethan Wu and Mike Bird. Guests: The Economist’s Cerian Richmond Jones, who has been reporting from Ukraine.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Venture forth: the VC race for the first trillion-dollar unicorn

35:43|Silicon Valley’s venture capitalists are getting jealous. But the target of that jealousy is not other investors—at least not other investors in the Valley. They’re jealous of the investors in ordinary public markets who, of late, have seen all the upside to the firms founded with their money. Nvidia became the world’s first $4trn company on Wednesday and CoreWeave, a cloud-computing provider, has seen its market value rise by over 300% since it listed in March. VCs are now trying to hold on to their investments for longer, hoping to breed the first $1trn unicorn. But will it work?Hosts: Mike Bird and Ethan Wu. Guests: Nathan Benaich, founder of Air Street Capital; and The Economist’s Henry Tricks.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.