Share

Money Talks from The Economist

Money Talks: Averting the city death spiral

Cities across the world are in the midst of an identity crisis. With fewer workers commuting into offices and more shoppers heading online, what are they now for? It’s a question that commercial real estate investors are scrambling to find an answer to.

On this week’s podcast, hosts Tom Lee-Devlin, Mike Bird and Alice Fulwood explore an office block that’s been repurposed to find out what the future holds for cities. Nick Bloom, a professor of economics at Stanford who’s been researching home working for more than two decades, tells them fully remote work can dent productivity by 10%. And Ed Glaeser, chair of the economics department at Harvard and one of the world’s leading experts on urban economics, says that troubled cities like San Francisco need to focus on making their downtown areas safe.

We would love to hear from you. Please fill out our updated listener survey at economist.com/podcastsurvey

Sign up for our new weekly newsletter dissecting the big themes in markets, business and the economy at www.economist.com/moneytalks

For full access to print, digital and audio editions, subscribe to The Economist at www.economist.com/podcastoffer

More episodes

View all episodes

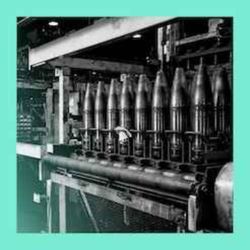

Combat capitalism: how Ukraine built a war economy

35:47|When Russia invaded its neighbour in 2022, Ukraine’s lack of industrial capacity put it at a distinct disadvantage. Typically, the country with the most factories was expected to win the war—and Russia had a lot of factories. But, as manufacturing has become more specialised and the tools of war have become more complex, the relationship between peacetime industrial capacity and battlefield success could be breaking down. This has huge implications for future wars.Hosts: Ethan Wu and Mike Bird. Guests: The Economist’s Cerian Richmond Jones, who has been reporting from Ukraine.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Venture forth: the VC race for the first trillion-dollar unicorn

35:43|Silicon Valley’s venture capitalists are getting jealous. But the target of that jealousy is not other investors—at least not other investors in the Valley. They’re jealous of the investors in ordinary public markets who, of late, have seen all the upside to the firms founded with their money. Nvidia became the world’s first $4trn company on Wednesday and CoreWeave, a cloud-computing provider, has seen its market value rise by over 300% since it listed in March. VCs are now trying to hold on to their investments for longer, hoping to breed the first $1trn unicorn. But will it work?Hosts: Mike Bird and Ethan Wu. Guests: Nathan Benaich, founder of Air Street Capital; and The Economist’s Henry Tricks.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

At the Vanguard: a visit to the man with $10trn under management

45:21|In 1975, Jack Bogle set up Vanguard with a single guiding principle: drive down fees for ordinary investors with funds that buy all of the stocks in an index, like the S&P 500. It made him unpopular with active investors who charged high fees and often underperformed the market. But among Vanguard investors, some of whom style themselves as “Bogleheads”, it earned him a cult-like status. Salim Ramji, the first outsider to lead Vanguard, is now at the helm, leading a charge into new higher-fee products. Will it work? This week, we pay him a visit.Hosts: Mike Bird and Ethan Wu. Guest: Salim Ramji, CEO of Vanguard.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Robo-copy: will AI eat the advertising industry?

43:23|Mark Zuckerberg recently shook the advertising world with Meta’s plans to allow businesses to use AI to generate targeted advertisements on Facebook and Instagram. Importantly, no ad agency would be involved in the process. So is the writing on the wall for the traditional advertising industry? Will the next viral video campaign or earworm jingle be the brainchild of a computer, rather than the fabled advertising creatives celebrated in the TV show Mad Men? And if so, what lessons are there for other creative industries?Hosts: Ethan Wu and Mike Bird. Guests: Sir Martin Sorrell, founder of WPP and S4Capital; Brian Wieser, CEO of Madison and Wall; and The Economist’s media editor Tom Wainwright.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Warning Vietnam: why the country’s new leader is worried

41:55|Vietnam’s economy may be booming—but To Lam, its new leader, isn’t happy. Over the past 15 years, the country has achieved 6% average annual growth, powered by new factories—which have sprung up from Hanoi to Ho Chi Minh City—to make goods destined for export, largely to America. But many of those factories are foreign-owned and don’t work much with Vietnamese firms. In addition Vietnam now risks being caught between a feuding Washington and Beijing. So what can Mr Lam do to revolutionise Vietnam’s economy?Hosts: Ethan Wu and Mike Bird. Guests: David Dapice, emeritus professor of economics at Tufts University; and Nguyễn Khắc Giang, a visiting fellow at the ISEAS-Yusof Ishak Institute in Singapore.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Vorsprung durch Technik: can Germany reinvent its economy?

41:44|Germany was once the economic powerhouse of Europe. But since 2019 its economy has barely grown. The country is now under new leadership—but is Friedrich Merz the man to pull Germany out of its perma-slump?Hosts: Ethan Wu and Mike Bird. Guests: The Economist’s Christian Odendahl; Monika Schnitzer, chair of the German Council of Economic Experts; and Philippa Sigl-Glöckner, founder of Dezernat Zukunft, a macro-finance think tank.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Tax assessor: Gary Cohn on Trump’s agenda

42:27|As a registered Democrat, Gary Cohn was an unexpected pick for Donald Trump’s chief economic adviser in 2017. He came on a mission to slash taxes, but left during the president’s first tariff war. Eight years later we interview Mr Cohn at the Reagan National Economic Forum, getting his take on the more-radical “Liberation Day” tariffs and the “Big Beautiful Bill” that would make permanent the tax cuts he crafted.Hosts: Mike Bird and Alice Fulwood. Guest: Gary Cohn, former director of America’s National Economic Council under Donald Trump and former president of Goldman Sachs. Recorded at the Reagan National Economic Forum.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Sea change: the SEC under Trump 2.0

43:58|During Joe Biden's presidency, the Securities and Exchange Commission was chaired by Gary Gensler. Under his leadership, America’s most powerful market regulator became more aggressive, imposing new disclosure rules for cyber-security and climate risk, and pursuing litigation against the burgeoning crypto industry. After the re-election of Donald Trump, Mr Gensler resigned from the SEC. What followed was one of the biggest U-turns in the regulator’s history. We speak to Mark Uyeda, the man Mr Trump appointed acting SEC chair on 20 January for three months until Paul Atkins, Mr Gensler’s permanent replacement, could be sworn in. What are the SEC’s new priorities, now that Mr Trump is back in power?Hosts: Mike Bird and Ethan Wu. Guest: Mark Uyeda, commissioner and former acting chairman of the SEC.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.

Don’t discount stores: how Walmart caught up with Amazon

45:33|Two decades ago, Walmart was on top of the world. The business model of cheap prices and giant big-box stores, pioneered by founder Sam Walton, had delivered a market share that no other American retail chain could touch. Then e-commerce arrived in the shape of a formidable new competitor—Amazon. Yet despite being written off at the time by pundits and investors as a retail dinosaur, Walmart has quietly reinvented itself as a tech company. Now it’s fast closing the gap on Amazon, and its huge presence in the physical world may even give it the edge on its online rival.Hosts: Mike Bird and Ethan Wu. Guests: Avantika Chilkoti, The Economist’s global business writer; Dan Bartlett, Walmart’s Executive Vice President for Corporate Affairs; Suresh Kumar, Walmart’s Chief Technology Officer; and Simeon Gutman, retail analyst at Morgan Stanley.Transcripts of our podcasts are available via economist.com/podcasts.Listen to what matters most, from global politics and business to science and technology—subscribe to Economist Podcasts+.For more information about how to access Economist Podcasts+, please visit our FAQs page or watch our video explaining how to link your account.