Share

The Wallet

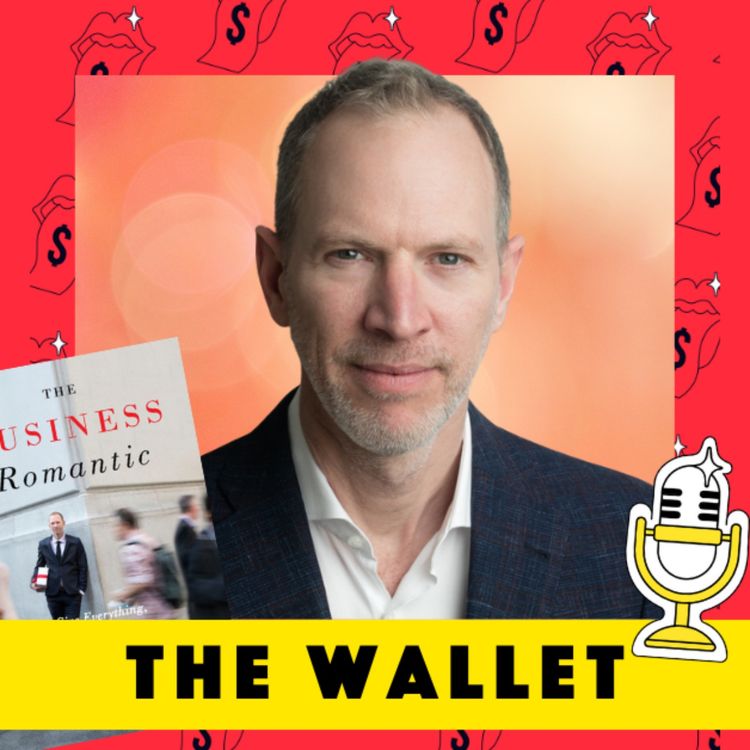

How to Put the Romance Back in Business? With Tim Leberecht

Have you ever wondered about the importance of romance in our lives and that we can find it in and through business? But also how to strike the perfect balance between career ambitions and personal happiness? In today's episode, Emilie Bellet is joined by Tim Leberecht, an author, curator, and entrepreneur, known as the co-founder of the House of Beautiful Business.

PARTNER

Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 229,000 customers saving with PensionBee. When investing, your capital is at risk.

CONNECT WITH VESTPOD

If you want to read the main takeaways from the episodes, subscribe to our newsletter: https://www.vestpod.com/subscribe

Instagram: https://www.instagram.com/vestpod/

RESOURCES:

Main takeaways: https://www.vestpod.com/news/the-wallet-podcast/romance-back-in-business-tim-leberecht

Tim Leberecht’s page: http://timleberecht.com/

The House of Beautiful Business: https://houseofbeautifulbusiness.com/

Listen to PensionBee’s monthly podcast, The Pension Confident Podcast to better understand the world of personal finance and pensions.

DISCLAIMER

We are not certified financial advisers! The articles and information made available on Vestpod are provided for information and educational purposes only and do not constitute financial advice. You are advised to consult with an independent financial advisor for advice on your specific circumstances.

More episodes

View all episodes

The Psychology Behind Holiday Spending With Psychotherapist Holli Rubin

37:41|December is filled with pressure, expectations, and spending. Gifts, Secret Santas, school events, family gatherings, and the emotional load of trying to keep everything running.Beneath the surface, many of us feel stressed, guilty, overwhelmed, and unsure why we keep spending more than we planned. In this episode of The Wallet, we ask a simple but honest question: why can’t we stop spending?Emilie Bellet is joined by psychotherapist Holli Rubin, whose work focuses on identity, behaviour, and the emotional patterns that shape the choices we make, including with money.Together, they explore what is really driving holiday spending, what happens in the brain under stress, and how to approach December with more awareness and less self-blame.Explore Vestpod’s upcoming courses and bootcamps: https://www.vestpod.com/coursesListen on Apple Podcasts, Spotify, or Podlink.Read our main takeaways on vestpod.com.Connect with Vestpod:Sign up to The Edit newsletter: https://www.vestpod.com/subscribe Follow on Instagram: https://www.instagram.com/vestpod/ Emilie’s book: You’re Not Broke, You’re Pre-Rich

Money Playbook for Freelancers

12:51|Freelancers, welcome to Episode 10 — the final episode of our Finances for Freelancers series. We’ve broken down the essentials every freelancer or solopreneur needs to feel confident with money — from budgeting and taxes to pensions and pricing.Today, we’re wrapping up with a punchy roundup — each of our expert guests shares one final, powerful tip to help you stay on track with your finances.Subscribe, share with a fellow freelancer, and listen now on Apple Podcasts, Spotify, or Podlink!If you liked this episode, discover the full series.#ad Listen to PensionBee’s monthly podcast, The Pension Confident Podcast to better understand the world of personal finance and pensions: Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.

How to Think Like a Business Owner

38:00|Freelancers, are you thinking beyond client work? In this episode of Finances for Freelancers, Victoria Nabarro FPFS, Chartered Financial Planner and founder of Veda Wealth, shares how to invest, scale your business, and build financial freedom.We cover smart ways to reinvest, outsource, create passive income, and set financial goals for growth. If you want to move beyond the freelance hustle, this episode is for you.For more resources, including links to Victoria's website and Instagram, check out the episode page.Subscribe, share with a fellow freelancer, and listen now on Apple Podcasts, Spotify, or Podlink!If you liked this episode, discover the full series.#ad Listen to PensionBee’s monthly podcast, The Pension Confident Podcast to better understand the world of personal finance and pensions: Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.

How Do You Create Consistent Income?

37:54|In this episode, we’re tackling one of the biggest challenges freelancers face: managing cash flow when income is unpredictable. How do you stay afloat during a slow month? What’s the best way to deal with late payments? And how can you create a more stable income without burning out?Joining Emilie Bellet is Lara Sheldrake—entrepreneur, community builder, and founder of Found & Flourish. Lara shares her personal strategies for staying financially steady in a freelance world: from tracking income and ghost spending, to diversifying revenue and planning for quieter months.We talk about setting realistic income goals, structuring your week with a CEO day, and working with your energy—not against it.For more resources, including links to Lara and Found & Flourish’s websites and social media, check out the episode page. If you found this helpful, make sure to listen to our next episode for more expert tips on managing your finances as a freelancer! If you liked this episode, discover the full series.Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.

How to Budget with a Fluctuating Income

31:24|Feeling overwhelmed by budgeting when your income isn’t consistent? In today’s episode of Finances for Freelancers, we’re looking at how to take control of your money—even when your earnings fluctuate.Our guest is Emilie Nutley, a money coach and financial strategist (and qualified Financial Advisor!) who helps creatives and solopreneurs build sustainable money systems. She’s here to walk us through:✅ How to budget when your income varies✅ Planning for big, irregular expenses like tax bills✅ Simple financial systems to stay organised and confident✅ Mindset shifts to help you feel less anxious and more empowered about moneyFor more resources, including links to Emilie’s website and social media, check out the episode page. If you found this helpful, make sure to listen to our next episode for more expert tips on managing your finances as a freelancer! If you liked this episode, discover the full series and read the main takeaways.Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.

Freelancer Pensions 101

22:10|In this episode, we’re tackling a topic that freelancers often put on the back burner: pensions. How do you start saving for retirement when you don’t have a traditional workplace pension? How can you make the most of tax relief? And what are the best strategies for long-term financial security?Joining Emilie Bellet is Lisa Picardo, Chief Business Officer UK at PensionBee. Lisa is here to break down why pensions matter for freelancers, how to set one up, and what you can do today to secure your financial future.If you found this helpful, make sure to listen to our next episode for more expert tips on managing your finances as a freelancer! If you liked this episode, discover the full series.#ad Listen to PensionBee’s monthly podcast, The Pension Confident Podcast to better understand the world of personal finance and pensions: Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.

Get Paid What You’re Worth as a Freelancer

36:31|Pricing your services can feel overwhelming, but getting paid fairly isn’t just possible—it’s essential. In this episode of The Wallet by Vestpod, hosted by Emilie Bellet, sales expert Sara Dalrymple shares how to shift your mindset around pricing, set rates based on value and outcomes rather than hours, and create a business that supports both your income and your lifestyle.This conversation will help you move away from undercharging, navigate seasonal shifts in your business, and build a pricing strategy that feels right for you. Sara also explores the importance of community and how surrounding yourself with the right people can help you grow with confidence.For more resources, including links to Sara Dalrymple’s website and Instagram, check out the episode page.Subscribe, share with a fellow freelancer, and listen now on Apple Podcasts, Spotify, or Podlink!If you liked this episode, discover the full series.#ad Listen to PensionBee’s monthly podcast, The Pension Confident Podcast to better understand the world of personal finance and pensions: Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.

Taxes Demystified: What Every Freelancer Needs to Know

24:19|In this episode, we’re diving into a topic that many freelancers find overwhelming: taxes. How do you stay compliant, maximise your deductions, and avoid costly mistakes? Joining Emilie Bellet is Emma Hardwick, Chartered Certified Accountant. With years of experience supporting freelancers and business owners, Emma is here to demystify tax and share practical tips to help you navigate self-assessments, VAT, expenses, and everything in between.If you found this helpful, make sure to listen to our next episode for more expert tips on managing your finances as a freelancer! If you liked this episode, discover the full series.#ad Listen to PensionBee’s monthly podcast, The Pension Confident Podcast to better understand the world of personal finance and pensions: Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.

Risk Management: Protection & Insurance for Freelancers

19:44|Feeling uncertain about protecting your finances as a freelancer? In today’s episode, we’re diving into risk management—a crucial but often overlooked part of financial planning for self-employed professionals.From income protection and business insurance to emergency funds, having the right safeguards in place can make all the difference when life throws the unexpected at you.I’m joined by Zoe Brett, a financial planner at EQ Investors, who will break down:✅ The key types of insurance freelancers should consider✅ How to balance costs with the right level of protection✅ Practical ways to build an emergency fund—even when your income fluctuatesFor more resources, including links to Zoe’s website and social media, check out the episode page.If you found this helpful, make sure to listen to our next episode for more expert tips on managing your finances as a freelancer! If you liked this episode, discover the full series.#ad Listen to PensionBee’s monthly podcast, The Pension Confident Podcast to better understand the world of personal finance and pensions: Connect with Emilie:Sign up to The Edit newsletterFollow Vestpod on InstagramEnroll in our upcoming bootcampsGet Emilie’s book: You’re Not Broke, You’re Pre-Rich#ad Thank you to our partner PensionBee. With PensionBee you can combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join over 265,000 customers saving with PensionBee. When investing, your capital is at risk.