Share

The Other Hand

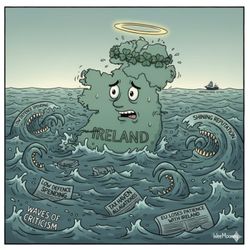

Politics & opinion polls in Ireland, UK & US. Why are Sinn Fein suffering because of immigration? Have they lost vital momentum?

Opinion polls on both sides of the Atlantic tell fascinating stories. Sinn Fein has lost momentum. Have they peaked too soon? Rishi Sunak's Tories are now polling at lower levels that the nadir of Liz Truss' government. That really is some going. Trump breaks wind audibly in court, hears stories about his sexual peccadillos and goes up in the polls.

It is said that SF are suffering because 'they have let their electorate down because of immigration'. Right wing parties everywhere, including Ireland, are on the rise because of the immigration issue. Yet right wing governments in power in the UK and Italy show how hard - impossible even - 'solving' immigration is.

Is it really true that immigrants take jobs? Spoiler alert: no.

What are SF's actual policies? Are they like the UK's Labour party, a policy-free zone? Long on promises, short on what they will do?

We are almost certainly still filling our cars with Russian fuel.

China and Russia deepen ties. China enables the Russian war machine. China has the best batteries.

Global stock markets continue to tell us: 'don't worry, be happy!