Share

Tax Software for CA

Know the Steps for Filing TDS Returns Using Gen TDS Software

•

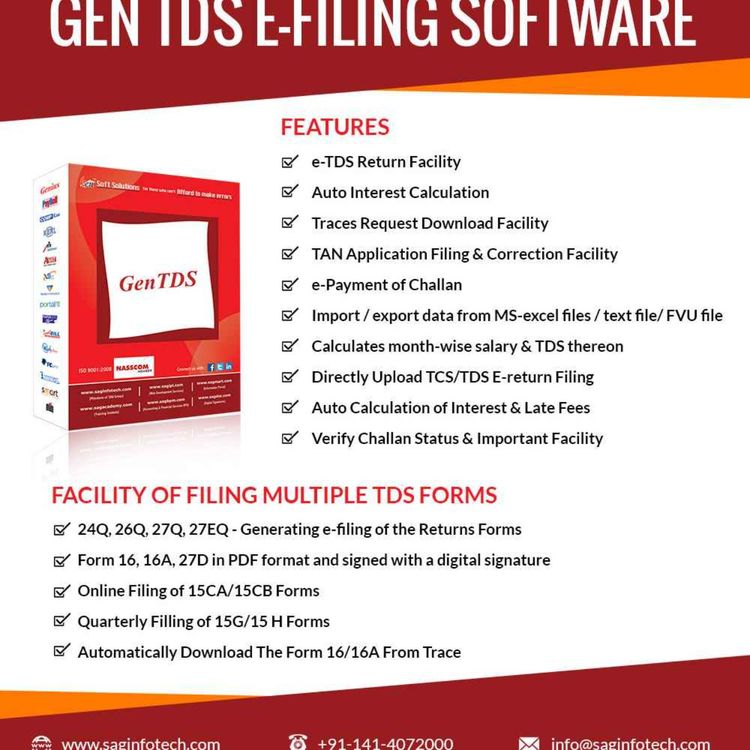

Gen TDS is a widely used software for TDS return filing and has features for calculating the TDS amount, tax penalty, interest, data import and export, and late fee filing. Its UI interface is specifically designed to facilitate taxpayers in filing TCS and TDS returns in compliance with the latest rules and regulations. The TDS return filing software not only helps taxpayers but also prepares TDS returns and additional functionalities. read more - https://saginfotech.wordpress.com/2019/04/24/file-tds-returns-gen-e-tds-software/

More episodes

View all episodes

Gen XBRL, a User-Friendly MCA Software Solution by SAG Infotech

02:55|Gen XBRL is a widely used and trusted MCA compliance software available in the market. Developed by SAG Infotech Private Limited, it is designed to simplify the preparation and filing of financial statements in XBRL format as prescribed by the Ministry of Corporate Affairs (MCA). The software is especially useful for professionals such as chartered accountants, company secretaries, and corporate compliance officers, enabling them to efficiently prepare and e-file balance sheets and profit and loss accounts in the latest XBRL format. Read also: https://browsemycity.com/services/business-services/gen-xbrl-software-385313

How to Claim Double Taxation Relief Under Section 90 via Form 67

02:03|This article breaks down the idea of getting tax relief under Section 90. It highlights the importance of a specific form called Form 67 and answers the question of whether you can submit this form after the deadline has passed. View more information about Income Tax relief for double taxation U/S 90 with Form 67:- https://blog.saginfotech.com/income-tax-relief-double-taxation-us-90-form-67

Manage HR and Attendance Seamlessly with Gen Online Payroll Software

02:02|In today’s fast-paced work environment, the adoption of advanced digital tools has become essential for HR teams managing large volumes of employee data. SAG Infotech Private Limited offers a powerful solution Gen Online payroll software designed to simplify and automate key HR operations. This comprehensive software efficiently handles crucial tasks such as salary calculations, attendance tracking, maintenance of investment records, management of employee contact and personal details, leave administration, and organised employee data management. Find more details here: https://www.freeclassifiedssites.com/0/posts/16-Services/144-Financial/1572993-Gen-Online-Payroll-Software-for-HR-and-Attendance-Management.html

Gen Online Payroll Software: A Smart All-in-One Solution for HR Operations

01:07|Gen Online Payroll is an enterprise-grade HCM solution engineered to meet the complexities of the modern global workforce. Developed by SAG Infotech, India’s premier taxation software provider, the platform centralizes critical HR and payroll operations into a unified framework. Beyond automated salary processing, the suite offers robust modules for real-time attendance tracking, investment validation, and comprehensive leave administration. By digitizing employee lifecycles from personal records to contact management, Gen Online Payroll ensures data integrity and operational efficiency across the organization. Get complete details here: https://faydaindia.com/services/other-services/gen-online-payroll-software-an-all-in-one-hr-solution_i6824

Key Updates and FAQs for Income Tax Changes Effective April 2026

02:30|Effective April 1, 2026, the Income Tax Act 2025 will officially supersede the legacy framework that has governed Indian taxation for over six decades. This landmark legislation serves as the statutory vehicle for the reforms introduced in the Union Budget 2026–27, aligning the tax code with modern economic realities. From redefined slabs for salaried taxpayers to structural shifts for corporations and HUFs, the new Act codifies the policy mandates announced on February 1. This comprehensive guide provides a strategic roadmap of the new legal landscape, delineating critical shifts, identifying preserved provisions, and addressing essential implementation FAQs. https://saginfotech.wixsite.com/about/post/new-income-tax-law-april-2026-key-changes

SAG Infotech Private Limited – A Leader in Taxation Software Solutions in India

02:20|Founded in 1999, SAG Infotech Private Limited has established itself as a key player in the Indian financial technology sector over the past quarter-century. Headquartered in Jaipur, Rajasthan, known as the 'Pink City', the company focuses on developing essential and user-friendly taxation solutions specifically designed for Chartered Accountants (CAs) and Company Secretaries (CSs). SAG Infotech boasts a comprehensive product lineup, with its flagship Genius suite and specialized modules such as Gen GST, Gen Payroll, and Gen XBRL. These tools are meticulously crafted to simplify the complexities inherent in the contemporary Indian regulatory environment. View further details at the following link: https://faydaindia.com/company/sag-infotech

Next-Gen AI Data Import Add-Ons by SAG Infotech ROC Software

02:54|Make ROC compliance easier and faster with SAG Infotech ROC Software. It features a new tool that uses artificial intelligence to help you quickly import financial data, ensuring you get results that are both smarter and quicker. To view more information about AI Data import addons in the SAG Infotech ROC software:- https://blog.saginfotech.com/new-ai-data-import-addons-sag-infotech-roc-software

Gen Payroll Software: Smart Payroll and Compliance Solution for HR Professionals

01:07|Gen Payroll is a comprehensive and user-friendly Human Capital Management (HCM) solution designed to enhance the efficiency of HR and payroll processes. It enables HR professionals to carry out precise salary calculations, produce accurate statutory payslips, and maintain strict adherence to Indian labour laws. By automating essential compliance tasks such as TDS, PF, ESI, and bonus accruals, this software minimizes the need for manual input and significantly reduces the chances of errors in procedural compliance. Also read: more details at the link below: https://browsemycity.com/services/business-services/gen-payroll-software-386066

Gen Balance Sheet Software for Professional Financial Reporting

01:35|Gen Balance Sheet is a premier automation tool tailored for Chartered Accountants and corporate tax entities. This industry-leading software enables users to finalise company financial statements with exceptional ease. With its highly intuitive interface, it allows one-click generation of complex balance sheets and profit & loss reports. By leveraging robust data-import capabilities and seamless integration with various accounting systems, Gen Balance Sheet significantly accelerates the reporting cycle while eliminating the risk of manual data-entry errors. Please refer to the official resources provided via this link. https://browsemycity.com/services/business-services/gen-balance-sheet-software-386095