Share

Tax Software for CA

How Credit Notes Impact GST and Business Transactions?

•

This section explains how credit notes affect GST and business transactions. When a supplier needs to reduce the value of an already issued invoice, they must issue a credit note. Additionally, businesses with a turnover exceeding ₹5 crore during the financial year 2024-25 are required to generate e-invoices for credit notes starting on April 1, 2025. https://saginfotech.bravesites.com/entries/i/credit-notes-how-impact-gst-business-transactions

More episodes

View all episodes

SAG Infotech: Specialized Tax Software for Chartered Accountants, Company Secretaries, and HR

01:32|SAG Infotech has established a significant presence in the financial industry by developing a wide range of taxation software solutions for businesses and professionals across India. The company has created specialized tools designed for Chartered Accountants (CAs), Company Secretaries (CSs), HR professionals, and other finance experts. Its popular software lineup includes Gen Income Tax, Gen TDS, Gen XBRL, Payroll, Complaw, and Gen GST, among others. Read for more: https://www.techimply.com/profile/sag-infotech7 Company Registration Mistakes You Must Avoid in India

01:21|This blog highlights the seven common mistakes entrepreneurs should avoid during the process of company registration in India. Seven company registration mistakes like wrong category selection of the company, not having a unique company name, failure to organize the essential documents in advance, failure to organize the essential documents in advance, unable to submit the wrong form or incomplete details, missing DIN and dsc before the registration process, unable to complete GST registration, neglecting compliance and legal obligations, etc. View more:- https://blog.saginfotech.com/mistakes-avoid-registering-company-indiaChecklist: Documents You Must Have for an Income Tax Audit

03:15|This article breaks down the important documents you need to have for an income tax audit. If you earn money from running a business or doing professional work, it's crucial to keep good financial records to follow the rules set by the Income Tax Act. These records can include things like your accounting books, cash register details, ledgers, journals, and other necessary paperwork. Keeping everything organized will help you during an audit. To know more information about the documents required for Income Tax audit:- https://blog.saginfotech.com/list-documents-income-tax-audit

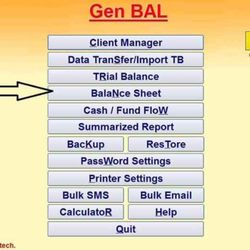

Gen Bal Software for Audit and Balance Sheet Data

01:35|The Gen Balance sheet software is used to help prepare balance sheets and profit and loss accounts. It can effortlessly import data from third-party accounting tools like Busy, Excel, and Tally ERP. The software contains significant financial data, your trial balance and account statements, and creates a tax audit report for 3CA, 3CB and 3CD, etc. It also takes care of all the essential facts about a company’s assets and tax importance. It facilitates the accounting and tax audit process and manages and shares your financial data. read more - https://saginfotech.gumroad.com/l/gen-balance-sheet-softwarePF and ESI Return Filing Using Gen Desktop Payroll Software

01:54|SAG Infotech's Gen Desktop HR Management is a software used to manage daily operations associated with worker attendance and records. Also, offline payroll software variant shows different benefits, such as improved data protection and the capacity to operate without an internet link, confirming that associations operate with limited connectivity. This software saves valuable time and substantially improves overall efficiency and productivity for human resource management. read more - https://saginfotech.gumroad.com/l/gen-desktop-payroll-softwareComplete Guide: New TDS Certificate Rules for Non-Residents

02:54|Are you living abroad and want to lower or even avoid the tax that's taken from your income? New rules have recently made it simpler for non-residents to get certificates that can reduce or eliminate these tax deductions. Keep reading to learn how these updates can help you manage your taxes more easily. To know more information about TDS Certificate Rules for Non-Residents:- https://blog.saginfotech.com/rules-tds-certificate-non-residentsGen TDS Software: Complete Solution for Online TDS/TCS Filing and Challans

01:55|Gen TDS is a widely recognised software solution designed for the efficient filing of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) returns. Developed by SAG Infotech, this user-friendly software aims to simplify the complex process of tax return filing while ensuring high accuracy. It is utilised by companies, professionals, and individuals alike, as it helps maintain compliance with the latest regulations established by the Income Tax Department (ITD). By leveraging Gen TDS, users can enhance their tax management practices, making the entire process more efficient and streamlined. Read more: https://www.postallads4free.com/financial_services-ad914747.html

A Guide to Using Gen Income Tax Software to File ITR-1 Easily

03:32|In the current digital age, taxpayers have the convenience of filing their income tax returns online via the government’s e-filing portal or through authorised tax software. To make this process more accessible, we offer a straightforward step-by-step guide for filing ITR-1 using the Gen Income Tax Return Filing Software. The Income Tax Laws consist of a framework of government provisions aimed at establishing a standardised system for tax collection nationwide while also addressing unethical practices like tax evasion. https://blog.saginfotech.com/itr-1-filing-genius-income-tax-softwareUsing Gen GST to Compare IMS Data with the ITC Register

03:29|Learn how to use Gen GST software to compare data from your Invoice Management System (IMS) with the ITC register. We'll also explore the main differences between these two systems to help you better understand how they work together. To know more information about how to compare IMS Data with the ITC Register via Gen GST software:- https://blog.saginfotech.com/compare-ims-data-itc-register-gen-gst