Share

Tax Software for CA

Gen TDS: Fast & Easy TDS/TCS Filing Software for Taxpayers

•

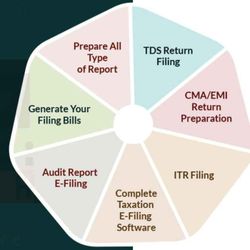

In the modern world, taxpayers need easy TDS/TCS return filing software. To view the requirements of the tax professionals, SAG Infotech developed very-well Gen TDS software for error-free return filing. It easily prepares TDS returns, calculates interest and penalty along with late filing fees all at one destination. This software is designed for filing the TDS and TCS returns. Get a free demo of our Gen TDS /TCS returns filing software.

More episodes

View all episodes

New Digital Form 16: The Next Generation of ITR Filing with Added Benefits

02:48|The Government of India has launched a new digital version of Form 16 as part of its Digital India program. This move is designed to make it easier and more modern for people to file their Income Tax Returns (ITR). The updated digital form will help salaried individuals across the country file their taxes more quickly and accurately, making the whole process simpler and more user-friendly. To know more information about the new digital form 16: next-gen ITR filing with advantages:- https://blog.saginfotech.com/new-digital-form-16

Genius Software: SAG Infotech's Tax Filing Solution Designed for Experts

01:21|SAG Infotech’s Genius software is a highly regarded tax filing solution specifically designed for Chartered Accountants (CAs) and tax professionals within the finance sector. It features six comprehensive modules: Gen BAL, TDS, IT, CMA, Form Manager, and AIR/SFT, each aimed at simplifying intricate tax-related processes. The software boasts advanced capabilities, including data backup and restore options, as well as secure password settings, making Genius one of the top taxation software solutions available in India. For read more: https://blog.saginfotech.com/genius-tax-filing-software-ca-cs-professionalsITR-B Form Explained: Due Date, Eligibility, and Important Notes

03:30|The Income Tax Department has introduced a new form called ITR-B for taxpayers. This form is designed for people who need to report any income they haven’t mentioned before, but only if they found out about it after September 1, 2024. To learn more about who needs to use this form and how to fill it out, be sure to check out the full article. View more information about the new ITR-B Form:- https://blog.saginfotech.com/new-itr-b-form

Gen IT Software Update: AIS/TIS and Summarized Reports Now Available

02:37|SAG Infotech’s Genius Software introduces a new feature package that enhances user convenience and accuracy. Clients can now easily select from the list available under the Gen Income Tax and Computation tabs. This update is especially useful for taxpayers who wish to view and verify their summarized reports. The newly added feature includes AIS/TIS—Annual Information Statement and Taxpayer Information Summary—allowing users to seamlessly import the AIS/TIS form, update information, and automatically sync the latest client details within the software. Read also: https://blog.saginfotech.com/gen-it-software-facility-ais-tis-summarized-reportsTax on Salary Over ₹12 Lakh After Applying Standard Deduction

04:11|Learn how to calculate income tax for salaries over ₹12 lakh under the new tax rules starting April 1, 2025. This includes a new standard deduction of ₹75,000 to help reduce your taxable income. To know more information about Income Tax on salary above ₹12 Lakh + standard deduction:- https://blog.saginfotech.com/income-tax-salary-above-12-lakh-standard-deductionApril 1 Rule Changes: How New GST, IT, and Banking Norms Will Affect You

01:25|Starting on April 1, 2025, the government will introduce new financial rules that will affect things like taxes and banking. One important change is that when you log into the GST portal, you will need to use a new security system called Multi-Factor Authentication (MFA). This is designed to make your data safer and improve security. Learn more information about the new financial rules from April 1:- https://blog.saginfotech.com/new-financial-rules-april-1-gst-it-banking-changeSteps to Explanation of the ISD Mechanism Under GST with the Same PAN

03:31|In this article, we'll explain how the Input Service Distributor (ISD) system works under the GST. You'll learn how businesses that are part of the same company (and share the same tax identification number) can share their tax credits more effectively. We’ll also cover the main rules and requirements they need to follow to stay compliant with the law. View more information about the ISD mechanism under GST with the same PAN:- https://blog.saginfotech.com/isd-mechanism-gstEasy Guide to Correct Form 26QB on TRACES Website

03:44|This post offers an easy-to-follow guide on how to fix mistakes on the Form 26QB (which is related to tax on property) online using the TRACES website. It also clarifies the difference between important and less critical information that needs correcting. To know more information about the correct form 26QB online on the traces website:- https://blog.saginfotech.com/correct-form-26qb-online-tracesA Guide to Gen Income Tax Software on Myzips.com Website

01:55|Gen Income Tax Software, developed by SAG Infotech, offers multiple features that simplify the filing of income tax returns (ITRs) for users. It supports the e-filing of the latest tax forms, ranging from ITR-1 to ITR-7, allowing you to submit returns online without the need for traditional paperwork. A particularly useful feature enables you to preview how the ITR-6 form will be assessed based on the latest updates, making it easier to understand any recent changes. The software is designed to assist you with everything required for filing tax returns and even automatically selects the correct forms for your needs. read more - https://www.myzips.com/software/Gen-IT-Software.phtml