Share

Tax Software for CA

Do You Require Standalone Tools or an Integrated Solution for HRMS vs. Payroll Software?

•

Understanding the difference between HRMS and Payroll Software is essential to determine which solution best suits your organisation’s needs. While both systems offer crucial features, they serve distinct purposes. This article compares Human Resource Management Systems (HRMS) and Payroll Software by highlighting their key features and benefits. It also explains whether your business needs one system or both. The decision depends on several factors, including the size of your business, the nature of HR operations, integration requirements, and the level of scalability and automation needed. For more information, please follow the link provided below. https://saginfotech.flazio.com/articles/post/281226/hrms-vs-payroll-software

More episodes

View all episodes

Complete Information to Import Excel Data into GST Software

02:18|This guide provides a simple, step-by-step approach to help you import your Excel data into GST software. It makes the process easy and ensures your information is transferred smoothly and accurately. To know more information about Import data from Excel into GST Software:- https://blog.saginfotech.com/import-data-excel-gst-software

Why TDS Mismatch Happens and How to Correct It Online

01:55|TDS plays a role in the complicated procedure of income tax return filing. It acts as a security for the state, provided that taxes are collected on income. It’s important to know that if the TDS credit reflected in the online return aligns correctly with the balance shown in TDS Form 26AS, there is always a chance that the AO may seek further scrutiny for any differences in the reported TDS amount. This action is especially consequential if the officer already processed the ITR or if taxpayers receive information from the CPC. read more - https://saginfotech.wordpress.com/2023/08/31/tds-mismatch-causes-how-rectify-portal/

Salaried Employees: Submit Form 12BB by the January Deadline to Prevent Excess TDS

03:05|Meeting tax deadlines is essential for maintaining financial health. If you are concerned about excessive tax withholding, submitting Form 12BB by the January deadline is the most effective solution. This document serves as your official declaration for all tax-saving investments.By detailing your eligible deductions now, you can lower your monthly TDS and avoid the stress of a reduced paycheck in the final quarter of the fiscal year. Click here for more information and comprehensive details. https://saginfotech-ca-software.weebly.com/home/salaried-employees-avoid-higher-tds-form-12bb

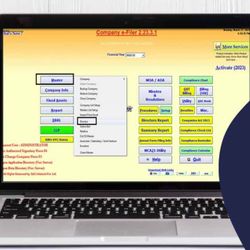

Simplify the TDS Form 27EQ to 15CA Using TDS Filing Software

01:57|The introduction of advanced software solutions can greatly simplify these complicated procedures, ensuring compliance with all applicable laws. Among these, the TDS return filing software appears as an exclusive option, delivering robust features to support finance experts in efficiently handling forms for tax declarations and the platform. With its detailed tax calculations and instinctive user interface, TDS software helps to make the often burdensome task of tax compliance, changing a traditionally difficult procedure into a more effortless one. read more - https://blog.saginfotech.com/from-15ca-27eq-how-tds-software-handles-forms

Step-by-Step Guide: Filing the DIR-3 KYC e-Form Using Gen Complaw Software

02:38|Gen Complaw Software is a leading solution for managing MCA V3 e-Forms, XBRL filings, resolutions, minutes, registers, and comprehensive MIS reporting. For businesses and professionals looking to streamline their DIR-3 KYC filings, Gen Complaw offers a seamless, integrated approach. This guide provides a detailed walkthrough of the filing process, including the core purpose of the DIR-3 KYC e-form, essential data requirements, necessary documentation, and the critical legal consequences of non-compliance. Read also: https://blog.saginfotech.com/file-dir-3-kyc-gen-complaw-software

Top HR Operations That Benefit from Automation

02:53|The article talks about important and time-consuming tasks in human resources (HR) that can be made easier with automation. These tasks include managing employee attendance and hiring new staff. By utilising automation, companies can save time and effort, enabling HR teams to focus on more critical tasks. View more information about essential HR operations that should be automated:- https://blog.saginfotech.com/essential-hr-operations-should-automated

How Online Gen-GST Software Ensures Accurate ITC in GSTR-3B

02:39|SAG Infotech’s online Gen GST software makes it easy to calculate and report your Input Tax Credit (ITC) when filing the GSTR-3B form. This user-friendly, cloud-based solution simplifies the GST return process so that you can file your taxes without any hassle. To know more information about the Gen-GST Software eases accurate ITC in GSTR-3B Form:- https://blog.saginfotech.com/online-gen-gst-software-eases-accurate-itc-gstr-3b-form

SAG Infotech Updates Prices for Taxation Software Products

02:42|The SAG Infotech software company has announced a new pricing plan for its taxation and GST software. This update reflects the acquisition of new elements and modifications. The revised fees impact product plans such as Genius, MCA/ROC filing, XBRL, Online GST, and others. This software keeps up with essential regulations for taxes, goods and services tax, company registration, and payroll compliance. The updation in pricing is aimed to provide users with more features and professional requirements. In this post, we have explained the pricing list of SAG Infotech products. read more - https://blog.saginfotech.com/new-price-list-sag-infotech-software-tax-practitioners