Share

Moneylife News Bites

Sky-High Promises, Grounded Reality

Ep. 189

•

Is India’s booming aviation sector failing its flyers?

From flight delays, sudden cancellations, and poor compensation to strategic refund delays—this video breaks down the real story behind India’s chaotic air travel experience, featuring the ordeal of former bureaucrat EAS Sarma and insights from Sucheta Dalal.

More episodes

View all episodes

207. Smart New Mandis: The HFN Way for Farmers

16:06||Ep. 207India’s farmers are stuck in a cycle of low income, middlemen exploitation, and volatile markets. But a new digital movement is changing the game.Meet the Harvesting Farmers Network (HFN)—a tech-driven initiative using WhatsApp, AI, and on-ground Saarthis to connect over 3 million farmers directly to buyers, raising incomes by 2.5x on average.This video unpacks how HFN’s model may just be the future of farming in India.🎥 Featuring insights from Sucheta Dalal’s Crosshairs column.📈 Real stories. Real data. Real impact.👉 Watch and share – the agri-revolution is here.

206. Why RBI’s KYC Fix Falls Flat

16:22||Ep. 206The Reserve Bank of India’s latest draft circular on KYC updates promises relief but delivers little. Despite repeated warnings and a powerful committee report, the RBI has failed to impose enforceable rules that stop banks from arbitrarily freezing customer accounts—especially those of vulnerable Jan Dhan and DBT beneficiaries.Sucheta Dalal explains how the proposals, while sounding consumer-friendly on paper, still lack standard operating procedures, accountability, or penalties for banks that harass customers. With no clear redress or compensation, India's poorest continue to suffer account freezes and denied welfare payments—while the RBI remains in observation mode.

205. India Can No Longer Avoid the China Question

06:53||Ep. 205As China rises to dominate sectors like electric vehicles, AI, defence, and green tech, India finds itself at a crossroads. In this thought-provoking commentary, Debashis Basu examines how China’s economic and technological supremacy is reshaping global power—and why India can no longer afford to ignore the implications.From rare earth dependency to trade imbalance and geopolitical risks, this video explores the urgent challenges India faces in countering China’s growing influence and what steps need to be taken to stay competitive.Watch till the end to understand why India needs not just ambition, but strategic intent and execution to safeguard its future.

204. फर्जी ऑनलाइन फॉर्म्स

06:13||Ep. 204क्या आपने कभी ऐसा ईमेल या मैसेज देखा है जिसमें लिखा हो – “अपना KYC अपडेट करें वरना आपका अकाउंट बंद हो जाएगा”? अगर हां, तो सावधान हो जाइए! इस वीडियो में हम बता रहे हैं कि कैसे फेक ऑनलाइन फॉर्म्स के ज़रिए लोग ठगे जा रहे हैं — और कैसे आप खुद को इन फ्रॉड्स से बचा सकते हैं।Yogesh Sapkale आपको बताएंगे:✅ फेक फॉर्म्स कैसे दिखते हैं✅ कौन-कौन सी जानकारी मांगी जाती है✅ ये स्कैमर्स कैसे आपको फंसाते हैं✅ और सबसे ज़रूरी – इससे कैसे बचें?

203. Regulators & Conflicts of Interest: India’s Blind Spot

15:37||Ep. 203SEBI's new chairman, Tuhin Kanta Pandey, has openly acknowledged a serious lapse in transparency standards—an admission that starkly contrasts with past denials. In this powerful commentary, Sucheta Dalal breaks down the urgency of reforming SEBI’s outdated and voluntary conflict of interest code.She argues that the High-Level Committee (HLC) must go beyond a cosmetic fix and set new benchmarks for all Indian regulators—from fixed tenures and cooling-off periods to blind trusts and broader definitions of conflicts.

202. सोशल मीडिया इन्वेस्टमेंट स्कैम: एक क्लिक में जिंदगी की कमाई गई!

06:40||Ep. 202क्या आपने व्हाट्सएप, टेलीग्राम या इंस्टाग्राम पर ऐसे मैसेज देखे हैं — “10 हज़ार लगाओ, 1 लाख पाओ!” या “सेलेब्रिटी भी कर रहे हैं इन्वेस्ट!”?इस वीडियो में योगेश सापकले ने खुलासा किया है कि कैसे सोशल मीडिया के ज़रिए चल रहे इन्वेस्टमेंट स्कैम्स लोगों की मेहनत की कमाई को मिनटों में साफ कर रहे हैं।▶️ दुबई का Gulf First Commercial Brokers स्कैम▶️ फर्जी स्टॉक ग्रुप्स और पोन्ज़ी स्कीम्स▶️ डीपफेक सेलेब्रिटी वीडियो और नकली क्रिप्टो इन्वेस्टमेंट▶️ SEBI रजिस्टर्ड होने का झांसा▶️ भारत के सॉफ्टवेयर इंजीनियर, दिल्ली के इंस्टाग्राम स्कैम — असली कहानियाँ

201. IPO Mania is Back! But You Have been Warned

16:28||Ep. 201The Indian markets are once again witnessing a surge in Initial Public Offerings (IPOs), particularly in the SME segment, with the BSE SME IPO Index soaring by over 5,000% since 2021. But beneath this rally lies a growing storm of fraud, deception, and regulatory blind spots that could wipe out unsuspecting retail investors.In this in-depth analysis, veteran journalist Sucheta Dalal unpacks the disturbing pattern of IPO abuse, collusion by merchant bankers, and shockingly blatant diversion of funds by newly listed companies. From Synoptics Technologies to Varyaa Creations and Trafiksol ITS, the list of dubious SME IPOs is growing — with SEBI scrambling to catch up.With 8 out of 10 investors entering the market post-2021, there’s an entire generation with no memory of the IPO scams of the 1990s. Back then, it ended in a spectacular bust. Will history repeat itself?Sucheta Dalal makes a powerful case for investor vigilance: “Caveat Emptor – Buyer Beware” must be your mantra in today’s overheated IPO market.

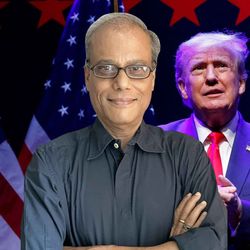

200. Tariff Deals: End of the Beginning

06:41||Ep. 200In a bold move, Donald Trump has demanded that Apple manufacture iPhones in America—not India—threatening to upend global supply chains and India’s manufacturing ambitions. In this video, Debashis Basu explains why Trump's tariff threats are not just about trade deficits, but part of a larger push for reshoring manufacturing to the US, no matter the cost or feasibility.

199. Judges, Markets & Mistrust - The Implications

13:35||Ep. 199Why are Indian judges so wary of investing in capital markets? Even as Supreme Court judges have begun to disclose their assets—a rare step towards transparency—Sucheta Dalal examines what their conservative investment patterns reveal. Is it ethics or risk aversion? And what are the consequences of a judiciary that appears disconnected from financial markets, regulation, and the needs of investors?