Share

Moneylife News Bites

Beware! Dangerous Attachments on WhatsApp, SMS & Emails

Ep. 184

•

Cybercriminals are using malicious attachments disguised as wedding invitations, job offers, and bank alerts to steal your data and money! Learn how to spot and avoid these dangerous scams on WhatsApp, SMS, and emails. Stay alert, stay safe!

More episodes

View all episodes

214. SEBI Slaps Jane Street – But is the Market Broken?

16:18||Ep. 214SEBI’s explosive interim order against Jane Street—a US-based quant trading giant—uncovers alleged large-scale manipulation of India’s derivatives market. With Rs43,000+ crore in profits and Rs4,843 crore impounded as illegal gains, the case raises serious questions about the depth, fairness, and infrastructure of our markets.Veteran journalist Sucheta Dalal breaks down the complex mechanics of the alleged expiry-day rigging, compares it to the infamous NSE co-location scandal, and asks: is India’s capital market too shallow and surveillance too weak to handle global algorithmic players?

213. NSE's Rs1400 Cr Offer: Settlement or Silence?

19:01||Ep. 213Can a ₹1,400 crore payout wash away nearly a decade of regulatory failure, whistleblower allegations, and inconclusive investigations?In this video, Sucheta Dalal unpacks the complex and controversial story of the NSE’s long-stalled IPO, the infamous co-location (Colo) scandal, and the Securities and Exchange Board of India’s (SEBI) role in what many see as regulatory drift.From token penalties to opaque settlements and a ₹20 billion valuation at stake, this is not just the story of one exchange—it’s a revealing look at how power, money, and market infrastructure intersect in Indian finance.

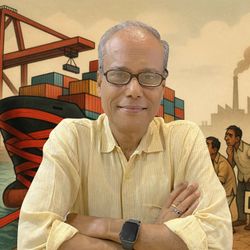

212. Industrial Policy Is Back Again. Can India Get it Right?

08:32||Ep. 212Industrial policy is making a global comeback—and India is no exception. From PLI schemes to the Make in India campaign, the country is trying to reduce dependence on Chinese imports and boost domestic manufacturing. But are these efforts working? This video breaks down Debashis Basu’s sharp analysis on why India’s approach still misses the fundamentals: ease of doing business, education, logistics, and institutional reform. Can we get it right this time, or will history repeat itself?

211. Vijay Mallya: A Podcast, A Spin, A Comeback?

23:40||Ep. 211Vijay Mallya, once the symbol of corporate excess, is now attempting a surprising comeback — not to India, but in public perception. In a widely viewed podcast, he casts himself as a misunderstood entrepreneur who’s paid back more than he owed. But is this just slick PR or does it highlight deeper failures in India’s bankruptcy enforcement?

210. अम्बरीश बलिगा केस – Identity Fraud का पर्दाफाश

07:31||Ep. 210अम्बरीश बलिगा केस – Identity Fraud का पर्दाफाशशेयर बाजार के मशहूर इन्वेस्टमेंट एडवाइज़र अंबरीश बलीगा की पहचान का इस्तेमाल कर ठगों ने मासूम निवेशकों को निशाना बनाया है। इस वीडियो में जानिए कैसे हुई यह साइबर धोखाधड़ी, पुलिस और सिस्टम की उदासीनता का क्या मतलब है, और आम निवेशक इससे कैसे बच सकते हैं।हम आपको बताएंगे—🔍 कैसे फर्जी स्कैमर्स ने बलीगा की पहचान चुराई⚠️ पुलिस की लापरवाही और सिस्टम की कमजोरियां🛡️ आम निवेशकों को सुरक्षा के लिए क्या कदम उठाने चाहिए📢 और कैसे आप खुद को Deepfake और Identity Theft से बचा सकते हैं👉 यह वीडियो देखें और दूसरों के साथ भी शेयर करें ताकि जागरूकता फैले।

209. Air India’s Crisis Reveals a Deeper Rot

19:10||Ep. 209Air India's recent spate of flight failures has exposed deeper issues in India's aviation sector—from poor fleet maintenance and policy missteps to overdependence on just two major airlines. In this video, Sucheta Dalal dissects the structural weaknesses plaguing Indian aviation despite its booming demand.With grounded flights, poor safety oversight, crumbling infrastructure, and high operational costs, India’s dream of becoming a global aviation powerhouse is fast losing altitude.

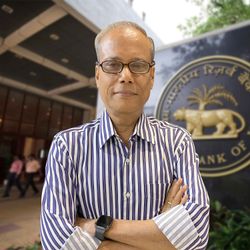

208. RBI Rate Cut Cannot Hide Structural Weaknesses

07:46||Ep. 208In this incisive video, Debashis Basu breaks down why the recent RBI rate cut won’t fix what truly ails India’s economy. From sluggish consumption and falling exports to weak private investment and overstretched government spending, Basu argues that India is facing a structural crisis, not a cyclical dip.Despite headline GDP growth of 6.5%, job creation is stalled, rural wages are stagnant, and consumption is faltering. Watch to understand why India’s economic strategy needs a complete rethink — and why monetary policy alone can’t rescue a faltering economy.

207. Smart New Mandis: The HFN Way for Farmers

16:06||Ep. 207India’s farmers are stuck in a cycle of low income, middlemen exploitation, and volatile markets. But a new digital movement is changing the game.Meet the Harvesting Farmers Network (HFN)—a tech-driven initiative using WhatsApp, AI, and on-ground Saarthis to connect over 3 million farmers directly to buyers, raising incomes by 2.5x on average.This video unpacks how HFN’s model may just be the future of farming in India.🎥 Featuring insights from Sucheta Dalal’s Crosshairs column.📈 Real stories. Real data. Real impact.👉 Watch and share – the agri-revolution is here.

206. Why RBI’s KYC Fix Falls Flat

16:22||Ep. 206The Reserve Bank of India’s latest draft circular on KYC updates promises relief but delivers little. Despite repeated warnings and a powerful committee report, the RBI has failed to impose enforceable rules that stop banks from arbitrarily freezing customer accounts—especially those of vulnerable Jan Dhan and DBT beneficiaries.Sucheta Dalal explains how the proposals, while sounding consumer-friendly on paper, still lack standard operating procedures, accountability, or penalties for banks that harass customers. With no clear redress or compensation, India's poorest continue to suffer account freezes and denied welfare payments—while the RBI remains in observation mode.