Share

Insurance Insight by DBS

Diversified Strategies Using Indexed Universal Life

Life insurance is often thought of simply as a tool that can help in the event of a death. But In addition to offering death benefit protection, indexed universal life (IUL) insurance policies also have the potential to build tax-deferred accumulation value based on interest received. So, it can create the opportunity for an additional source of funds that may be available to help your clients throughout life so they may be better positioned to respond to needs such as unplanned major expenses, helping with college tuition, or supplementing the lifestyle your clients want in retirement. Corey Luke joins Kurt Fasen to discuss how Indexed Universal Life provides:

Join our webinar to learn about:

- PROTECTION: The death benefit can help loved ones maintain their standard of living and is generally income-tax-free for your beneficiaries.

- ACCUMULATION: The potential to build tax-deferred accumulation value that is protected from market downturns.

- FLEXIBLE ACCESS: Any available cash value that’s accumulated in your policy can be accessed via policy loans or withdrawals to help supplement college funding, retirement, or other financial needs.

We’ll also share six potential diversified strategies using IUL and take a look at how various strategies would have performed at pivotal economic points in history. And, we’ll also talk about some exciting news about the Allianz product suite with the launch of Allianz Life Accumulator™.

More episodes

View all episodes

Exploring Long-Term Care Solutions: Panel Discussion Insights

43:14||Season 2025Long-Term Care Awareness Month kicks off November 1st – Register now for this important Panel Discussion!How in tune are you with the LTC options available for your clients? Long-term care is still a hot topic these days, and most advisors are adding some kind of LTC feature to the policies they recommend. Many of the DBS carriers have long-term care or chronic care riders, and several also offer a hybrid, or combination solution that combines life insurance with a long-term care element. There are some key differences you should know about before talking through these choices with your clients. Our upcoming webinar will help break down the options available for long-term care and how to determine what might be right for your client.In this session we will cover:Why a plan for long-term care is essentialOptions for paying for LTCWhat is Asset-Based Long-Term Care?What are the different options available for client solutions?Similarities and differences among the optionsFeaturing:Kurt Fasen, LLIF, LUTCFExecutive Vice President, Sales & MarketingDBS, ModeratorTim GohRegional Vice President - Linked BenefitsSecurian Financial - SecureCareRob Johnson, MBA, CLTC, LTCPSales Vice PresidentLincoln Financial - MoneyGuardKimberly LippsRegional Vice PresidentJohn Hancock - LifeCareJoseph TaylorCareMatters Regional WholesalerNationwide - CareMatters

Foreign Nationals: Navigating Opportunities Using Life Insurance

43:49||Season 2025The foreign-born population in the United States has been steadily growing since 1970—now representing a significant part of the nation’s fabric. Today, nearly 18 million children under 18 live with at least one immigrant parent, accounting for 26% of all U.S. children.As individuals and families from around the world settle in the U.S., they often encounter unique financial hurdles— from navigating unfamiliar systems to securing long-term protection. But with these challenges come powerful opportunities to build stability and legacy.Join our upcoming webinar to explore the evolving needs of the foreign national market. We’ll take a closer look at two key segments within this population, uncover the financial obstacles they face, and highlight how life insurance can serve as a strategic solution.In this webinar we’ll cover:Who are foreign nationals?Why is there a planning need?Where does life insurance fit in?How can you recognize opportunities in this market?Featuring:Kurt Fasen, LLIF, LUTCFExecutive Vice President, Sales & MarketingDBS, ModeratorVicente Pina, MBA, AEP, CLU, ChFC, FLMI, LLIFDirector, Advanced PlanningPrudential

Unlocking the Secrets of the Business Life Insurance Market

23:50||Season 2025Are you ready to supercharge your strategies and stand out in the competitive business life insurance landscape? Small to Mid-size Business (SMB) owners are offering more benefits and innovative solutions than ever before, proving that robust employee offerings can elevate recruiting, retention, and employee productivity. Each year the Principal Business Owner Insights survey asks business owners to rank their employee benefits and business owner solutions priorities. These insights reveal what SMB owners are doing and provides benchmarks for SMBs to prioritize their employee benefits package.Don’t miss our upcoming webinar—your backstage pass to what business owners really value and the essential ways you can champion their success by helping them turn ideas into powerful solutions.Here’s what you’ll discover in this high-energy session:The hottest trends and untapped opportunities in business planning techniquesInside perspectives on how business owners are adapting to economic uncertainty—and thrivingWinning conversation starters to engage and inspire business ownersProven solutions that deliver real results across diverse business needsAnd so much more!Level up your expertise, fuel your growth, and start making an even bigger difference for your clients. Reserve your spot today—success awaits!

Tax Planning Opportunities Under the New “One Big Beautiful Bill Act”

39:26||Season 2025The "One Big Beautiful Bill Act" (OBBBA), signed into law on July 4, 2025, finally settled the ongoing question of whether the tax rules from the 2017 Tax Cuts and Jobs Act would keep going or end in 2025. But, it's not just about keeping or ending those rules; the OBBBA also brings in new changes that financial advisors and their clients need to think about.In this webinar, join Terri Getman and Kurt Fasen as they dive into what the OBBBA is all about and share some tax planning strategies that clients can use now that the law is in place. We'll talk about the biggest new planning points that financial advisors should keep in mind, including:How the One Big Beautiful Bill will change the estate tax landscapeHow strategies like special needs trusts and charitable plans will be affectedThe possible long-term effects on business succession planningWhy making the 199A QBI deduction for pass-through entities permanent is a big deal for small business ownersWhat new planning ideas have come up because of the Connelly Supreme Court decisionThe main points of debate about the SALT deduction and how it could help people in high-tax statesA new type of account for kids called the Trump Account and its intended benefitsEXTRA: One Big Beautiful Bill Passes Key Committee VoteJust ahead of President Trump’s deadline the House of Representatives passed on Thursday July 3 the bill known as the “One Big, Beautiful Bill,” by a vote of 218-214, with every Democrat and two Republicans voting against it. The Senate narrowly approved the bill following a tie-breaking vote from Vice President Vance. The bill was signed into law on July 4th at an Independence Day celebration. Learn more about the key provisions every financial advisor should know.Learn More

Winning Tools & Sales Strategies for Today’s Economic Environment

22:19||Season 2025We’re excited to have Matt Redick, Business Development Vice President with Nationwide Financial join us for our upcoming Sales Accelerators webinar series, designed to offer some quick hits for Life Insurance strategies. Matt will join Kurt Fasen, DBS EVP of Sales & Marketing to talk about two ideas that are really working in today’s environment. Learn about how to talk to your clients who may find it difficult to take action during uncertain times and how life insurance provides stability and tax advantaged savings in an overall financial plan. Also, learn about a strategy for your business owner clients that also can provide some tax advantages. The session will provide some case studies and a walk-through of some tools that make it easy to discuss the topic with your clients!Featuring:Kurt Fasen, LLIF, LUTCFExecutive Vice President, Sales & MarketingDBS, ModeratorMatt Redick, CLU, ChFC, CLTCBusiness Development Vice PresidentNationwide Financial

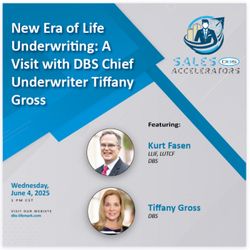

New Era of Life Underwriting: A Visit with DBS Chief Underwriter Tiffany Gross

28:23||Season 2025DBS recently named Tiffany Gross as its new VP, Chief Underwriter and with a new leader comes a fresh perspective on underwriting including some added perspective on what’s happening in the industry with respect to the underwriting process. Join this webinar to learn a little more about Tiffany and her approach to underwriting and what advisors can expect with a new Chief.We’ll cover:Recent Underwriting Changes in the IndustryAlternate Methods of Underwriting Being ExploredSpecific “Wins” in Underwriting with Case StudiesA Look at Field UnderwritingThe Future of UnderwritingFeaturing:Kurt Fasen, LLIF, LUTCFExecutive Vice President, Sales & MarketingDBS, ModeratorTiffany GrossVP, Chief UnderwriterDBS

Incorporating the “Pivot” Conversation

27:11||Season 2025There’s a disconnect for many Americans when it comes to life insurance, and a large majority are either uninsured or underinsured. In fact, 42% of American adults say they need (or need more) life insurance, representing a life insurance need-gap for about 102 million adults.* This makes it vitally important to include the life insurance conversation in all your planning meetings – whenever you get the chance. Sometimes, though, it can be hard to bring up the topic for a variety of reasons, or there can be objections on the part of the client.Join our webinar to learn about some natural ways to incorporate “the pivot” – a way to lean in, shifting the viewpoint of the client so they’re more open to the topic, and easing them in to understanding the need.Attend our webinar to gain insights on:The need to include life insurance in an overall portfolioCommon myths and perceptions about life insuranceHow to ask the right questionsWhere to find the openingsDeveloping your own pivot statement* LIMRA 2024 Life Insurance Barometer Study, July 2024Featuring: Kurt Fasen, LLIF, LUTCFExecutive Vice President, Sales & MarketingDBS, ModeratorMichelle Kosoi, CLTCField VP, Life Insurance Broad MarketPacific LifeScott Johnson, CLUField Vice President - Marketing Organizations, Life InsurancePacific Life

How to Grow Executive Life Sales

29:21||Season 2025One of the biggest challenges corporate leaders face today is how to recruit, retain and reward key talent. We’ve got a great opportunity to share that will bring a high-level insurance solution for your BEST corporate clients that helps solve this challenge, lead to significant revenue for you AND potentially protect your business from competition.The solution is a life insurance benefit for highly compensated employees that goes beyond the group term insurance plan. These plans are called Executive Carveout: Guaranteed type issue underwriting, no exams and it’s carved out just for the highly compensated employees. These solutions are designed with valuable features for employers and their leadership talent, so you can grow your business in the executive benefits market. DBS, partnering with Protective Life has the tools and information to make the process easy – every step of the way.Join our webinar to learn:Where to find the opportunityWhat executive carve-out is all aboutWhat the process looks likeCompanies and industries where this worksBenefits for the companyBenefits for the advisorFeaturing:Kurt Fasen, LLIF, LUTCFExecutive Vice President, Sales & MarketingDBS, ModeratorTom Hall, CLU, ChFC, CFPDivisional Vice PresidentProtective Life

Gearing the Conversation Toward Life Insurance and Compelling your Clients to Take Action

17:25||Season 2025For many consumers one of the biggest barriers to getting life insurance is simply the idea of having that awkward conversation. Because no one really likes talking about death or finances, it can often be difficult for financial professionals to get that conversation going. This webinar will offer some tips and tricks for framing the conversation around protecting families and loved ones—things everyone can comfortably speak to.Join our webinar which will include:Talking points for overcoming objectionsWays to dispel myths surrounding life insuranceConversation startersSpecific markets that have unique concernsResources for facilitating the saleHow we can make it easier for YOUFeaturing:Chuck AndersonVice President, National SalesDBS, ModeratorCasey CastagnaRVP, Business DevelopmentLegal & General Advisor Hub: https://www.lgamerica.com/advisorCampaigns in a Box: https://www.lgamerica.com/advisor/prospecting/campaigns-in-a-boxMarketing Resources: https://www.lgamerica.com/advisor/resourcesTerm-2-Term Exchange: https://www.lgamerica.com/term-2-term-exchange-program